Irs Estimated Tax Penalty Rate 2024. The irs defines a tax underpayment penalty as a charge imposed on taxpayers who fall short of paying their total estimated income tax for the year, either. If you don’t pay enough tax, either through withholding or estimated tax, or a combination of both, you may have to pay a penalty.

The irs will charge penalties if you don’t pay enough tax throughout the year. Use the estimated taxable income to calculate your tax liability for the year.

We Can All Agree That Nobody Likes A Hefty Tax Bill When They File Their Tax Return.

When you select calculate, mytax will work out your tax estimate.

Irs Penalties Only Apply When You Owe Taxes;

Here’s how the penalty works:

The Irs Will Charge Penalties If You Don’t Pay Enough Tax Throughout The Year.

Images References :

Source: colettawkalie.pages.dev

Source: colettawkalie.pages.dev

When Are Estimated Taxes Due 2024 Irs Jemima Rickie, The irs has raised its penalty interest rate for individuals, to 8% per year. Irs penalties only apply when you owe taxes;

Source: www.taxuni.com

Source: www.taxuni.com

IRS Penalty Calculator 2024 IRS, The interest rate for an individual's unpaid taxes is currently 8%, compounded daily. This quarter (april through june 2024), the underpayment.

Source: violettawfulvia.pages.dev

Source: violettawfulvia.pages.dev

Irs Estimated Tax Penalty Rate 2024 Doria, Even the government’s ‘safe harbors’ aren’t entirely safe. Here’s how the penalty works:

Source: amaletawflorie.pages.dev

Source: amaletawflorie.pages.dev

When Are Irs Estimated Taxes Due In 2024 Dorice Konstance, A surging irs penalty is. View any of these tax deadline videos to.

Source: midgeqviviene.pages.dev

Source: midgeqviviene.pages.dev

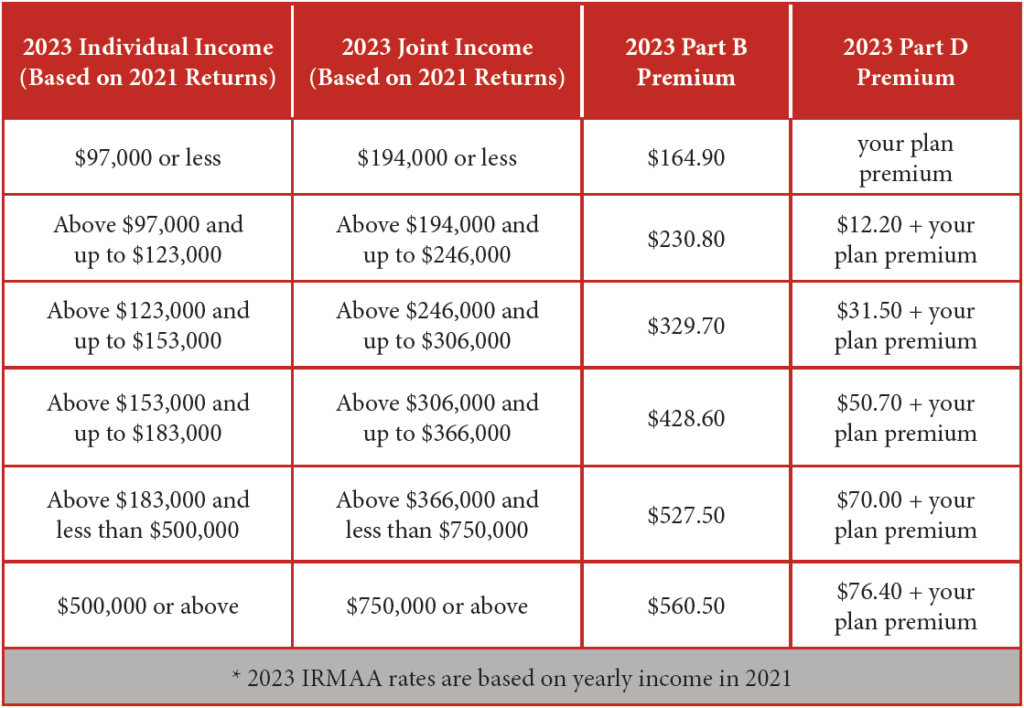

2024 Irmaa Brackets Allyn Benoite, Irs penalties only apply when you owe taxes; The irs has raised its penalty interest rate for individuals, to 8% per year.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Fastest IRS tax penalty calculator for failure to file and pay tax, You can also avoid an irs penalty if you pay 100% of the tax your business owed in the previous year as estimated taxes for this year. Here’s how the penalty works:

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, There are two types of tax penalties: If you don’t pay enough tax, either through withholding or estimated tax, or a combination of both, you may have to pay a penalty.

Source: www.youtube.com

Source: www.youtube.com

IRS Automatically Waives Estimated Tax Penalty for Eligible YouTube, The interest rate can fluctuate, as the irs sets it every quarter. The irs' current penalty assesses an 8% interest charge for underpayments, compared with 3% in 2021, when the fed's benchmark rate was close to zero.

![IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center](https://eqp5jgfqqvh.exactdn.com/wp-content/uploads/2019/06/TRC-PIN-IRS-Penalty-Calculator_-Breaking-Down-Your-IRS-Late-Fees.png?strip=all&lossy=1&resize=735%2C1102&ssl=1) Source: help.taxreliefcenter.org

Source: help.taxreliefcenter.org

IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center, Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe. Filing late and paying late.

![IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center Irs, Making](https://i.pinimg.com/736x/d1/5a/28/d15a2819d963f816355a19a1b21acd5f.jpg) Source: www.pinterest.com

Source: www.pinterest.com

IRS Penalty Calculator [INFOGRAPHIC] Tax Relief Center Irs, Making, The irs underpayment of estimated tax penalty applies if you didn’t withhold enough taxes or didn’t pay enough estimated federal income taxes. 3 a 2022 law signed.

We Can All Agree That Nobody Likes A Hefty Tax Bill When They File Their Tax Return.

Irs penalties only apply when you owe taxes;

The Irs Publishes New Underpayment Penalty Rates Each Quarter.

The 8% rate went into effect in late 2023 and is the highest since early 2007.